My outlook on October is a bit late but better late than never. ; )

First a short review of September:

In my post "Elliott Wave Outlook on September 2010" I wrote that I expected a bearish month unless "1040 holds and we get a strong rally starting tomorrow." Well, the next day the big rally occured and I turned bullish expecting a rally into mid September. I then stayed bullish until the SPX broke below 1136 on September 22th. Since then I've been standing aside waiting for the market to show its direction.

Outlook on October

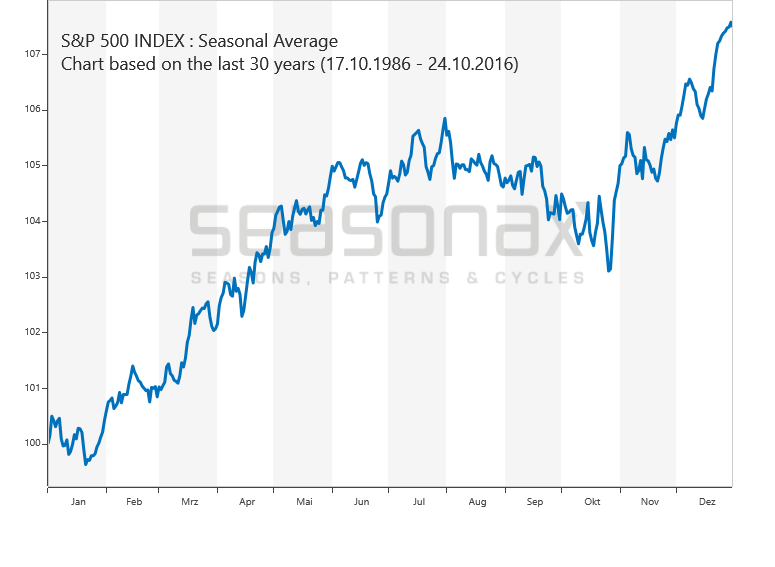

Since seasonality worked that well last month (.... : )) I decided to post a seasonal chart again:

We can see that early-mid October the SPX usually goes down but then in the last week the end of year rally starts. But since already September was upside down what if it happens again?

For almost three weeks now the SPX has been moving sideways (well, slightly higher) and as long as there is no major break down or up I'm standing aside.

On the upside 1170-80 is an important level. Should the market breach this level with conviction I think the bullish count below is underway:

If the market breaks the 1175ish level I think it will challenge the high at 1220. By the end of the year we could see 1300!

On the downside an important level is the neckline of the inverted H&S at 1130ish. If this level doesn't hold this market could go way lower in the coming months:

Interesting times ahead let's see which way the market decides to go ; )